OUR PUBLICATIONS

Starting from 2023, there is a new type of mutual fund that the investor can claim a tax deduction from the investment that he/she makes each year. That type of mutual fund is call “Thailand Environment Social and Governance fund” (TESG). Below is a summary of the rules for claiming a tax-deductible benefit from investing in the TESG:

- a taxpayer can claim a tax deduction for the purchase of TESG units of up to 30% of the gross taxable income, capped at 100,000 baht a year;

- a taxpayer must hold the TESG units for at least eight (8) (FULL) years from the date of investment;

- there is no minimum investment requirement. Therefore, taxpayers can invest any amount, and

- there is no condition to invest continuously. Therefore, the investment is not required every year.

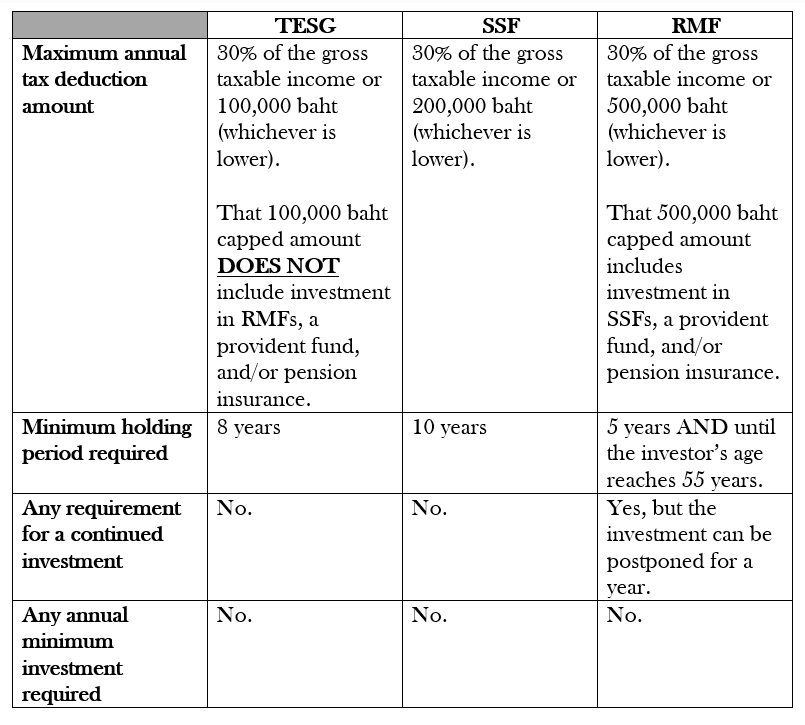

The table below compares the requirements for claiming a tax deduction benefit from investing in the TESG versus SSF and RMF:

We, N-Able Group, are a real proficient expert in Thai personal income tax matters, especially for the issues that concerns FOREIGNERS. If you have any further questions or need any assistance in any Thai taxation matters, please do not hesitate to contact us through the following channels:

Email address: info@nablecompanies.com

Telephone, WhatsApp, and Line: + 66 95 557 1410